In the previous part, we examined Bitcoin’s mining process and the halving schedule, which steadily reduces new supply and amplifies scarcity. We also explored the dynamics of liquid versus illiquid supply, showcasing how these trends contribute to Bitcoin’s increasing value. With this understanding, we now turn our focus to the broader implications of Bitcoin’s unique properties and its revolutionary potential.

Bitcoin’s Scarcity: A Hidden Advantage

Bitcoin’s scarcity isn’t fully appreciated by the market. Even seasoned investors often overlook the implications of Bitcoin’s diminishing supply. Understanding these dynamics can give you a significant advantage in forecasting its future value.

The 2024 Halving: Bitcoin Becomes the Hardest Money Humanity Has Ever known

If you’re not sure what “hard money” means, it’s simply money that is hard to produce. Think Gold historically.

The opposite is “easy money” which is usually government fiat currency (Pounds, Euros, Dollars etc.), which can be — and is — printed out of thin air by governments and their central banks. This is what — contrary to what Keynesian Economists may tell you — causes inflation.

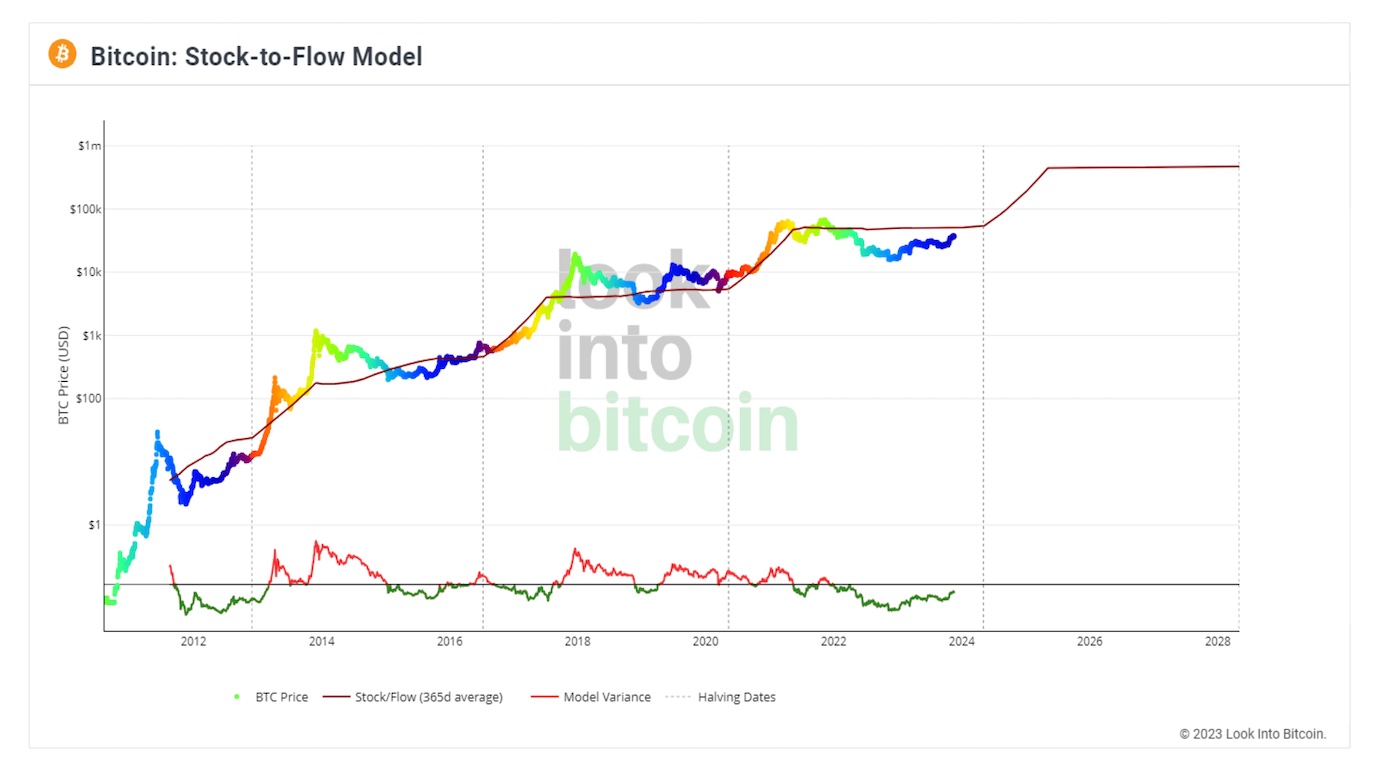

Hard Money is typically measured in terms of its “stock to flow” ratio.

Essentially its the annual new supply as a percentage of the total supply that exists.

Early next year when the halving happens, annual supply growth (or “Inflation”) as a percentage of the total supply will become ~0.8%

This means that less than 0.8% (gradually decreasing) of Bitcoins total supply will be mined per year until the next halving in 2028.

This will be looked back upon as a seminal moment in history because when it happens, it means that Bitcoin becomes the hardest money that humanity has ever known.

What I mean by that is that it overtakes Gold, which has a stock to flow of ~1.7%

I can’t overstate how important this concept is.

No matter how much energy is thrown at the Bitcoin network, you cannot produce more of it than the inflation schedule written in to the software allows.

An individual miner can produce more for themselves by investing in more mining equipment, but the total amount produced globally cannot be increased.

This is unique in history: Finality of Supply

With Gold, if the price rises, mining companies can spend more money, investing in more equipment, man power, and searching new territory to be able to mine more Gold.

In Uganda they have discovered $12.8 Trillion (yes, Trillion) worth of Gold under the ground which, if extracted, would more than double the supply of Gold (and therefor reduce its value by about 50%).

And NASA has just launched a space probe to investigate mining an asteroid – called Psyche — with an estimated $10,000,000,000,000,000 (that’s 10 Quadrillion!) worth of Gold in it.

If or when this newly found Gold is mined, it will dilute the value of Gold against Bitcoin to practically zero.

Regardless of whether it is actually ever mined or not, it illustrates the point: Gold does not have finality of supply.

Bitcoin does. It has a hard, fixed supply, and a programmatic inflation schedule that everyone knows in advance, making it totally unique in the history of the World.

Explore the last article in this series to learn the do’s and don’ts.