On the previous article, we explored the transformative potential of Bitcoin as the hardest money humanity has ever known. We examined its role in driving mass adoption, institutional interest, and how these factors create a perfect storm for its value to rise. With this foundation, we now move to practical strategies and steps you can take to capitalize on Bitcoin’s revolutionary potential.

The Perfect Storm

Bitcoin becoming the hardest money that has ever existed appears to be tying in perfectly with the so called “mass adoption” of the asset.

On top of that, most of it is simply not for sale, so people who want it will have to fight over the ~24% (and decreasing) “liquid” Bitcoin that’s available for sale today.

I would argue that we’re not yet at mass adoption, which I personally consider is the Worldwide acceptance of Bitcoin as preferred global monetary asset by humans (not necessarily by governments).

Put another way, we are still really, really early.

However large financial institutions such as BlackRock and Fidelity (as two examples amongst many) are now extremely pro-Bitcoin and are introducing Bitcoin investment products for their Millions of clients, including an ETF in the USA.

So, we see that just as understanding of this new monetary technology grows, at the same time the new issuance is going from a flood to a trickle…

In my opinion, humans are generally terrible at predicting the future.

We get used to the way things are, and find it difficult to imagine paradigm shifts in advance of them happening…

Think of the Internet, for example. It was a kind of obscure idea we had vaguely heard of. Then all of a sudden – seemingly overnight — everyone was completely reliant on it in just a few years!

And when the car was launched, people saw them as a novelty, which needed three operators; a Driver, an onboard Mechanic, and someone to walk in front of the car waiving a flag!

Very soon after, cars became ubiquitous.

And because of this “normalcy bias”, almost no one truly understands just how rare 1 Bitcoin is and what opportunity that presents for early adopters.

Currently, 6.25 Bitcoin are produced roughly every 10 minutes. However, there will come a time when all the mining power in the World won’t even produce a single Bitcoin in a whole year.

If you can get your head around that, I think you have a massive advantage over 99.99% of the population.

So… How do you become a “Bitcoin Millionaire” in the next 24 Months?

Lets start by how NOT to do it:

| Common Mistake | The Solution |

|---|---|

| Throw money in to Bitcoin while not really understanding what you are buying, then panic sell it during periods of price volatility. | Educate yourself on why Bitcoin is such an incredible asset. Then, you will be excited rather than scared during price declines because they allow you to buy more cheap SATs. |

| Use leverage to bet on the Bitcoin price going up. | You will probably get liquidated during price swings. And the exchange may well steal your Bitcoin (if it even existed in the first place). Instead buy real Bitcoin and withdraw it to your own self-custody cold storage solution. |

| Trade “shitcoins” to try to get more Bitcoin. | You will hear of people who’ve bought some kind of “memecoin” or “the next Bitcoin” (which doesn’t exist) and have generated 1000X gains in a few weeks. However, this is incredibly rare and these “pump and dump” schemes always trend to zero against Bitcoin over the long term. To be clear, almost everyone loses money doing this kind of “degen” trading. Instead buy Bitcoin and withdraw it to your own self-custody cold storage solution. |

| Buy Bitcoin and then leave it on an exchange. | You’re playing Russian Roulette with your money if you do this. Many exchanges have gone out of business and/or stolen customer funds throughout history. If you don’t hold your Bitcoin in cold storage, it’s not really your Bitcoin, and you should expect to lose it. |

So how DO you do it?

- Understand that Bitcoin is going up in purchasing power forever in our lifetimes

It takes research, and time in the market, to reach this conclusion. But you are clearly on the right path if you are reading this Report.

- Understand that this doesn’t mean that Bitcoin never goes down in price!

Bitcoin is a new asset class and although its volatility is decreasing over time — and will continue to do so — it is still highly volatile compared to more established assets. The key is to understand the macro trend, measured over years rather than weeks or months. It may go down at times, but over the longer term, its going up. And a LOT.

- Pull the trigger

This is the most important part of all. You need to actually buy the Bitcoin and then hold it in cold storage (both of which we can help you with).

I know it sounds obvious, but if you pontificate and wait for the price to go down to whatever arbitrary level you choose before buying, it may never get that low and you’ll end up buying Bitcoin at a much higher price in the future.

And if it does get as low as your price target during a market crash, you will likely then revise your target buy price down again, because the market sentiment will be bearish and you’ll be in a state of fear, believing that Bitcoin is going even lower, which – again – it may not do.

Once you understand how valuable Bitcoin is, you need to pull the trigger and actually buy it rather than trying to be “cute” with timing the market.

And if you’re scared that the price will go down, it really means that either you have a very short time horizon, or that you don’t really understand the opportunity. That’s fine, of course. But you are not going to get rich owning Bitcoin with this outlook in my view.

The Simple Calculation

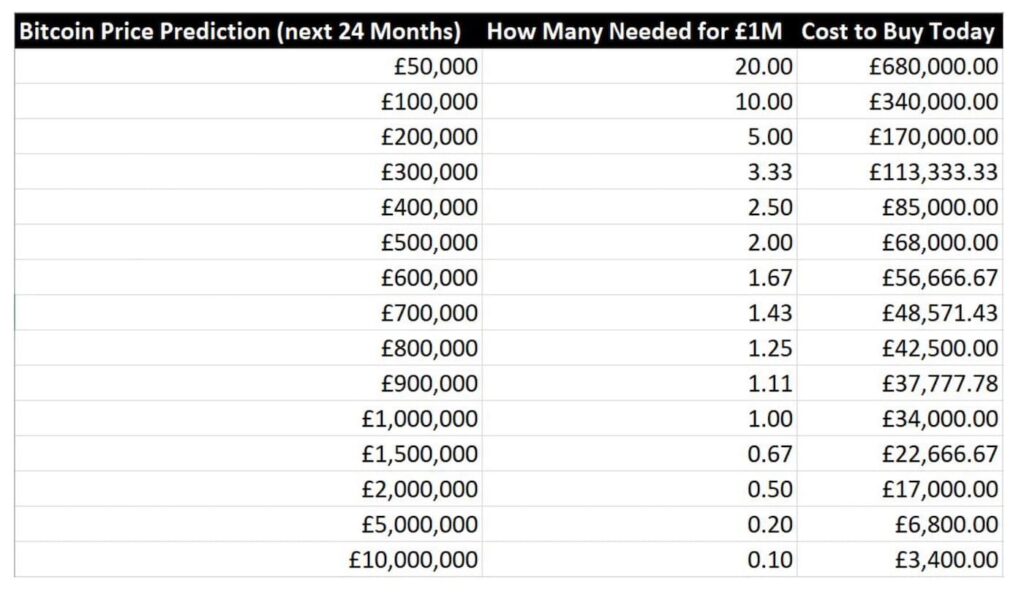

So, if we assume that you’ve taken the time to understand what Bitcoin offers, and why that makes it so valuable, you should be able to come up with an educated guess on where you think the price of Bitcoin is going in the next 24 Months.

Then it’s a simple calculation to work out how much Bitcoin you’ll need.

Remember we are talking about “how to become a Bitcoin Millionaire” here.

Personally, I don’t think in these terms. Rather I value my savings in Bitcoin.

But I appreciate that – as was the case with me – it’s the idea of financial gains in terms of pounds or dollars that brings most new Bitcoiners to the party, so let’s indulge the idea just for fun:

It’s important to stress that accurate price predictions are impossible. And they are even more difficult than that in short time frames 🙂

But if my hand was forced, I would personally predict somewhere in the middle of that price range, which, incidentally is also what Adam Back – who many consider to be Satoshi Nakamoto, the anonymous architect behind Bitcoin – predicts.

Make of that what you will – its certainly not financial advice!

Most important of all – have fun with the thought process.

Once you “get” Bitcoin and why it is such a technological and societal revolution, it does change the way you think. And for the better.

The overarching thought becomes that there is a huge opportunity here if you have the foresight to take advantage of it.

The more you know, the more confidence you will gain.

Knowledge allows you the privilege to take decisive action based on the courage of your own convictions, and that is one of the most liberating things you can ever do.