In the previous article of this series, we explored the concept of Bitcoin’s absolute scarcity and its potential to reshape global wealth dynamics. By understanding how Bitcoin’s limited supply influences its value, you’ve set the foundation for grasping the mechanics of its supply dynamics and mining process, which we will now delve into.

Mining and Inflation Schedule

What people think of as “Bitcoin” is the 96% of all Bitcoin that will ever exist that has been “dumped” onto the market since its creation in 2009.

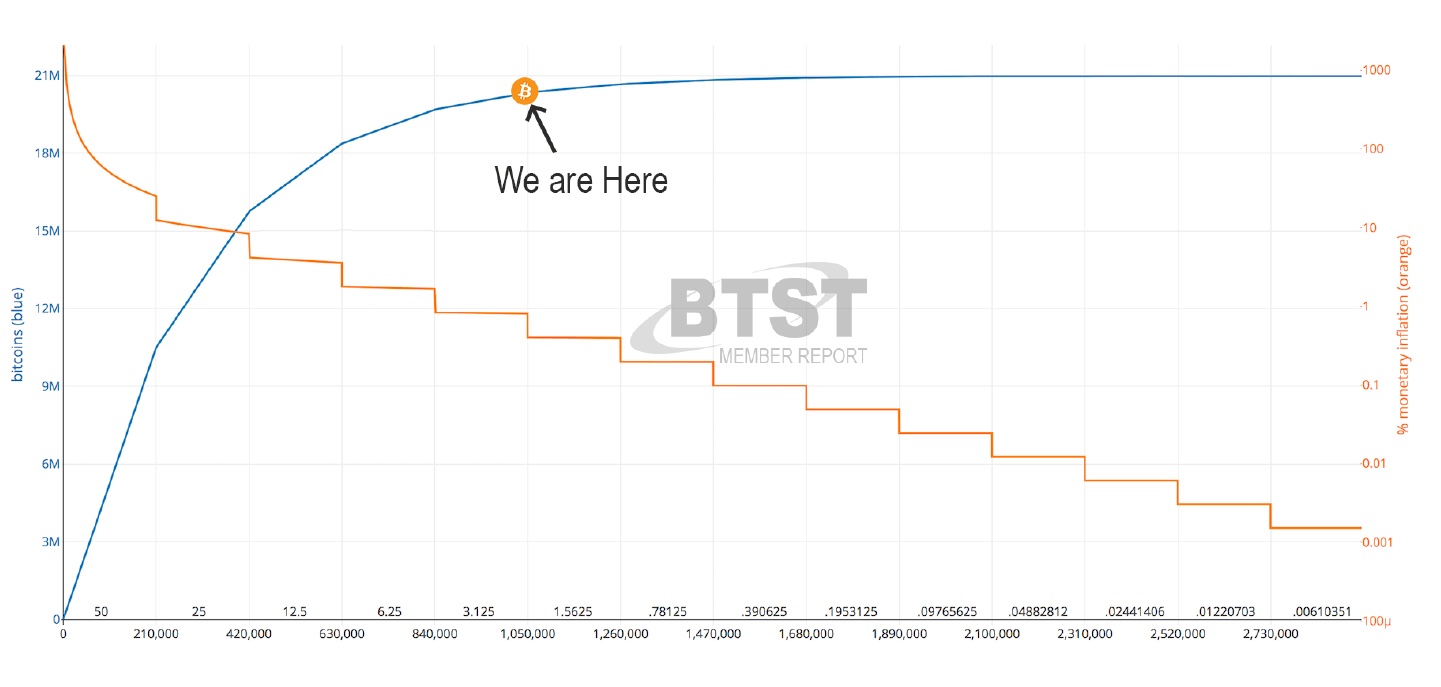

This is because of the programmatic inflation schedule for Bitcoin, which looks like this:

Bitcoin’s inflation schedule started with 50 Bitcoin per block when it launched in 2009. Every 210,000 blocks (approximately every 4 years), the inflation rate halves. For example:

- So, in 2012 it became 25 new Bitcoin per block mined.

- In 2016 it became 12.5 new Bitcoin per block mined.

- In 2020 it became 6.25 new Bitcoin per block mined, which is where we are today.

The next halving, projected for April 18, 2024, will reduce the block reward to 3.125 Bitcoin per block.

Sidenote: Its a projected date because the time of each block of transactions being mined is not the same – it varies depending on the mining Difficulty Adjustment. It’s not really important to understand this technicality to see the bigger picture, however.

The inflation rate will continue to half every ~4 Years until the year 2140, when the halvings stop and miners will be paid by transaction fees alone, with no “block subsidy” (currently they receive both transaction fees and the block subsidy).

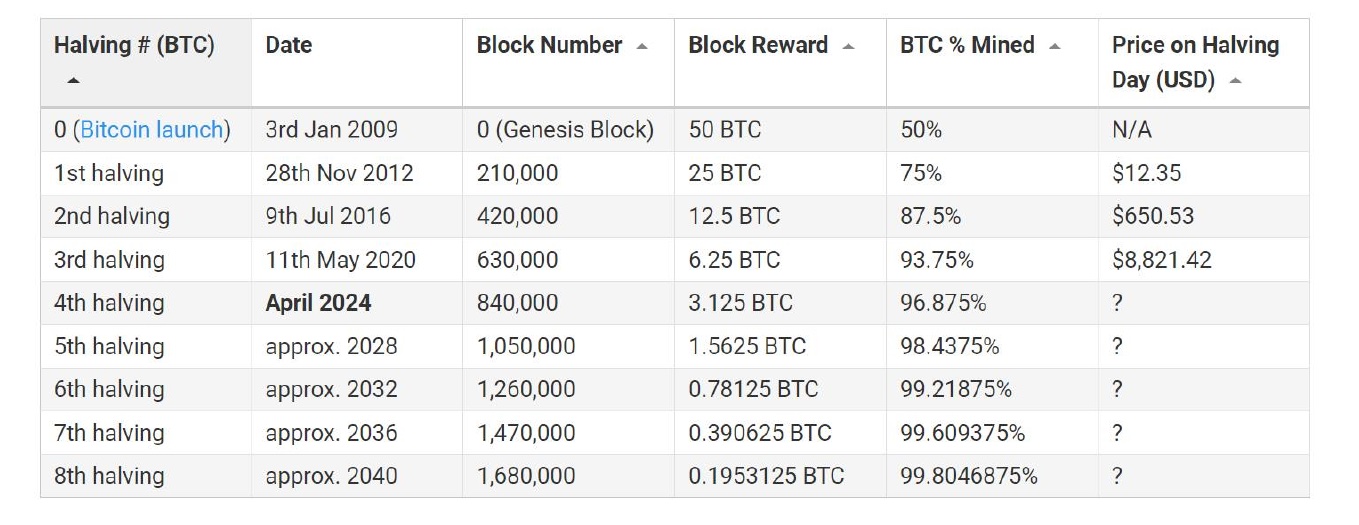

Here’s how the inflation schedule looks in a table:

So, after the next halving, buyers will be fighting over just 3.125% of the total supply that remains to be mined.

And this 3.125% will be slowly produced over the next ~116 Years, at a progressively slower and slower rate over time.

If demand for Bitcoin were to remain the same as it is today, you can imagine what this will do to the price over time!

When you have the same demand but much less supply, the price goes up due to the principle of supplyand demand.

However, its my belief that the demand will increase …exponentially.

You have to use your imagination (or perhaps an excel spreadsheet) to understand what’s likely to happen to the value of Bitcoin in this scenario…

Illiquid vs. Liquid Bitcoin Supply

The second “type” of Bitcoin that’s available for sale is Bitcoin which has already been mined in the past, when it was much easier to do so.

This is generally categorised as either “liquid” or “illiquid” supply.

- Liquid Supply: is the Bitcoin held by traders who jump in and out of it, selling when they think its expensive, and then buying again when they think its cheap.

- Illiquid Supply: by contrast is Bitcoin that has not moved in years, and is held in cold storage.

Its Bitcoin that’s either been “lost”, or is in cold storage held by hard core Bitcoiners who’ve “seen the light”, so to speak, and have no desire to sell their Bitcoin for an inferior money such as dollars or pounds.

So how do the “liquid” and “illiquid” supplies compare today?

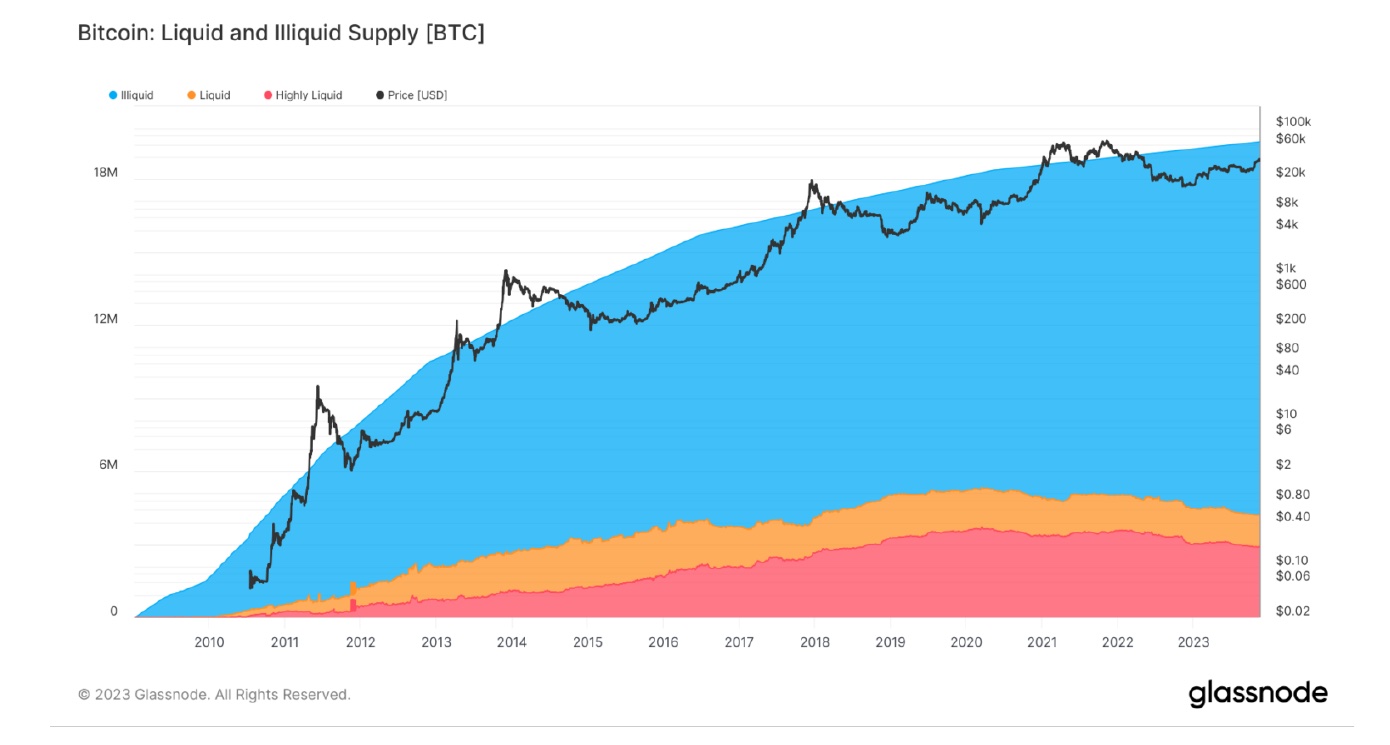

Because the Bitcoin blockchain is an open public ledger, you can get this data quite easily:

The Red section is highly liquid Bitcoin which is kept on exchanges (which is a terrible idea for the reasons explained later) and is available for sale at all times.

The Orange section is liquid Bitcoin that’s available for sale sometimes.

You can see that the vast majority of the Bitcoin — around 76% — is held by hard core Bitcoiners and is simply not available for sale!

The less Bitcoin there is for sale, the more the Bitcoin price will go up (measured in fiat currencies and other goods) because of the principle of supply and demand.

It’s my thesis that as more people become educated about Bitcoin and its properties as sound money, more and more of the supply will be “locked up” as illiquid supply.

This is a trend that’s supported by the data, as you can see above.

If you look closely, you can see that the illiquid (not for sale) Bitcoin is consistently increasing over time.

Conversely the liquid (available for sale) Bitcoin started to go down in 2020, and has continued to do so ever since.

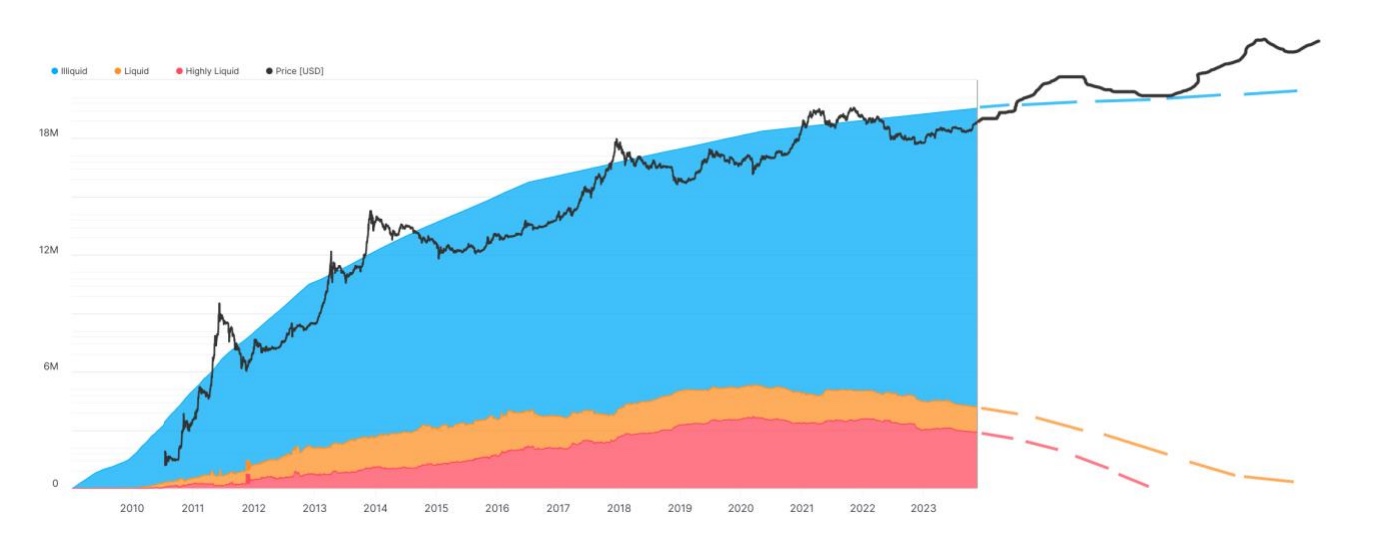

I propose that the trend will continue something like this in to the future:

This is because more and more Bitcoiners who were initially attracted by the idea of making a lot of money quickly have started to realise the true value of the asset, and prefer to hold on to it.

Assuming the trend continues (and I’m confident it will), it means that people trying to buy Bitcoin in the

future will be fighting over an ever smaller and smaller pool of liquid Bitcoin that’s actually available for sale…

Looking ahead, the next article will explore the revolutionary potential of Bitcoin as the hardest money humanity has ever known. We will discuss its role in driving mass adoption, institutional interest, and its transformative impact on the global economy. Bitcoin’s scarcity isn’t fully appreciated by the market. Even seasoned investors often overlook the implications of Bitcoin’s diminishing supply. Understanding these dynamics can give you a significant advantage in forecasting its future value.